- US equities decline for the second day. Netflix earnings up next

- The rates market thinks EUR/USD can get close to 1.20 - SocGen

- WTi crude oil settles at $80.61

- Gold climbs $30 to fresh the highest since April 2022

- More from Brainard: Measures of inflation expectations are in pre-pandemic range

- Fed's Brainard: It will take time and resolve to get inflation down to 2% target

- US treasury sells $17 billion of 10 year TIPS at 1.22%

- Atlanta Fed GDPNow remains steady at 3.5%. Tomorrow will be the last estimate for the 4Q.

- European equity close: First bad day of the year

- SNB's Jordan warns there's still tightening to come

- EIA weekly US crude oil inventories +8408K vs -593K expected

- Weekly US natural gas inventories -82B vs -71B expected

- VIDEO: The forex market reacts modestly to the better US data dump today

- Fed's Collins: It's appropriate to slow the pace of rate hikes

- Initial US jobless claims 190K versus 214K estimate

- US housing starts for December 1.382M versus 1.359 million estimate

- US January Philly Fed -8.9 vs -11.0 expected

- Canada November wholesale trade sales +0.5% vs +1.9% expected

- One data point at a time is the mode in the market

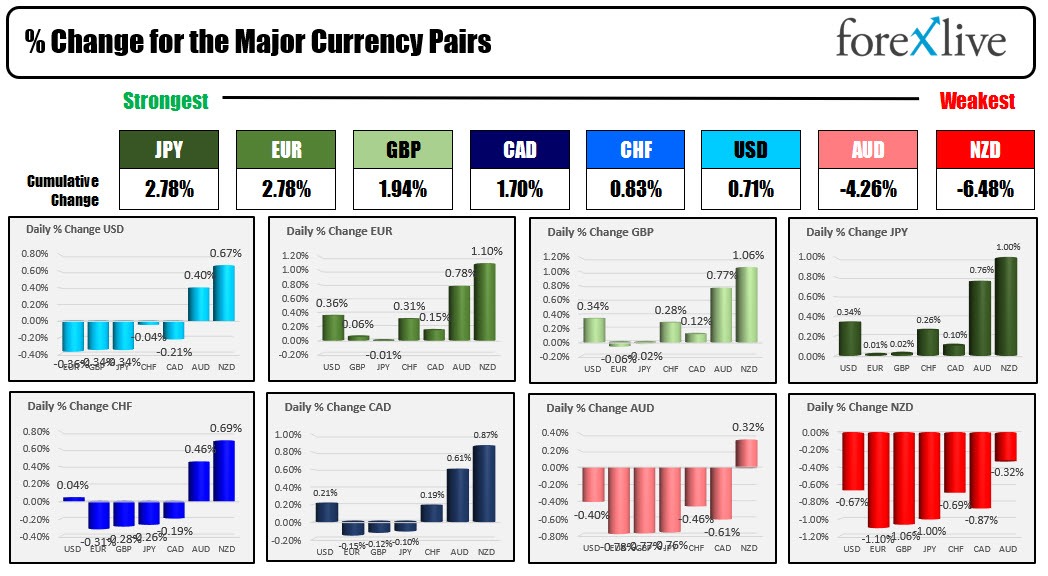

- The JPY is the strongest and the NZD is the weakest as the NA session begins

- ForexLive European FX news wrap: ECB push back, risk mood sours

The data today was not as weak as yesterday when the retail sales and Industrial production/capacity utilization scared the market toward a harder landing.

Today, the Initial claims data reminded the market that the jobs market remains tight and that will always be an inflation threat. The weekly number came in at 190K which was the lowest since April last year. Moreover, the data today corresponds with the survey week for the BLS's monthly jobs report which will be released the first Friday of February. Expectations will NOT be for a weak number.

PS Be Aware. That first week of February in addition to the jobs report on Friday, will have the Fed meeting on Wednesday (Feb 1) and these earnings releases:

Wednesday, February 1

- Meta-Platforms

- Alibaba

- PayPal holdings

Thursday, February 2

- Apple

- Amazon

- Visa

- MasterCard

- Merck and Company

- Bristol-Myers Squibb

- ConocoPhillips

- Honeywell

- Amgen

- Starbucks

- Ford Motor

Mark those days on your calendar.

A strong or even average jobs report is enough to to keep the Fed on a tightening path just because employment is at or near full employment. That is like an inflation time bomb ready to go off for the Fed, and we all know that they are ultra nervous about being the 2nd Fed - behind Volker - to declare inflation dead too soon, and be forced to have to restart tightening.

Also released today was the Philly Fed regional manufacturing index. That index came in at -8.9 which was better than the -11.0 expected and marginally better than the -13.9 last month. Although negative, it was a relief given the Empire manufacturing index released on Tuesday that plunged to -32.9 vs -8.9 estimate.

In the housing sector, Housing starts and building permits were lower than last month, but at least housing starts were better than expectations. The housing starts and building permits are still at the lowest level since June 2020.

With the Fed meeting approaching, the quiet period when the Fed officials are not allowed to speak will begin on Friday. Today Brainard spoke reiterating the oft spoken, "it will take time for inflation to return to 2%" line.

With inflation as the excuse dujour (and so many ways of defining it), I wonder when the excuse will be "It will take some time to get the employment rate above 4.0% (or some other number)."

Fed's Collins spoke to that idea a little today, when she said:

- Bringing labor market into better balance is 'critical' to achieving inflation target, still a long way to go.

In the forex, the JPY is ending the day as the strongest of the majors. The NZD is the weakest. The USD is ending mixed with declines vs the EUR, GBP, JPY and CAD, and gains vs the AUD and NZD. The USDCHF was near unchanged.

IN the stock market, the uncertainty, and some negative technicals in the broader S&P and Nasdaq indices contributed to another down day. For the Dow and S&P it is now on a 3 day losing streak. For the Nasdaq it fell for the 2nd consecutive day, after 7 days in a row higher to get 2023 off on the right foot.

Technically, the S&P closed back below its 200 day MA yesterday (negative technically) while the Nasdaq closed back below its 100 day MA (also negative).

Today the final numbers show:

- Dow -252.40 points or -0.76% at 33044.57

- S&P -29.99 points or -0.76% at 3898.85

- Nasdaq -104.75 points or -0.96% at 10852.26

In the US debt market, yields moved higher.

- 2 year 4.126%, +5.2 bps

- 10 year 3.392%, + 3 bps. The low yield near 3.31% tested the 200 day MA for the 10 year note

- 30 year 3.568% +2.7 bps

In other markets,

- Gold rose $27.74 or 1.46% to $1931.42. The price traded to the highest level since April 25th and came despite the dollar being mixed.

- Silver rose $0.38 or 1.62% to $23.8

- Crude oil rose despite another weekly surge in inventories. It is trading up about $1.00 from the settled price yesterday at $80.78

- Bitcoin is a smidge below $21,000 at $20977 near the 5 pm end of NY day.